Foundation's Edge

Why one of the most important essays of our times has an energy-shaped hole in it

The superlative essay Foundations has dominated the Westminster wonk scene over the Party Conference season. Its central thesis is that economic growth rests upon getting the foundations of the economy - investment, housing, infrastructure and energy - right. Therefore, we should no longer ban investment through mechanisms such as the planning system. We should aim to have energy prices that are as low as possible. It is difficult to argue with these assertions, even if they lack nuance. The only pushback this thesis has received I can only describe as naïve at best.

But where it seeks to explain why the UK’s energy prices are high it falls down. The energy section of the paper sits at odds with the rest of it; rather than arguing that the UK’s failing is to ban investment, it argues that the UK has invested in the wrong technologies. Unlike in the rest of the paper, this argument begins with elision rather than evidence:

Nuclear power in Britain is now half of what it was at its peak, and energy costs today are higher than they have been for a century.

There is no necessary relationship between the two halves of this sentence, nor is any effort made in the paper to justify running these two together. This is, to say the least, poor form. But given the quality of the rest of the paper, this poor form merits scrutiny.

In this post I want to examine this section of Foundations in greater detail and provide a sketch of an explanatory framework as to why the UK’s electricity prices are so high.

The Unassuring Expensiveness of UK Power

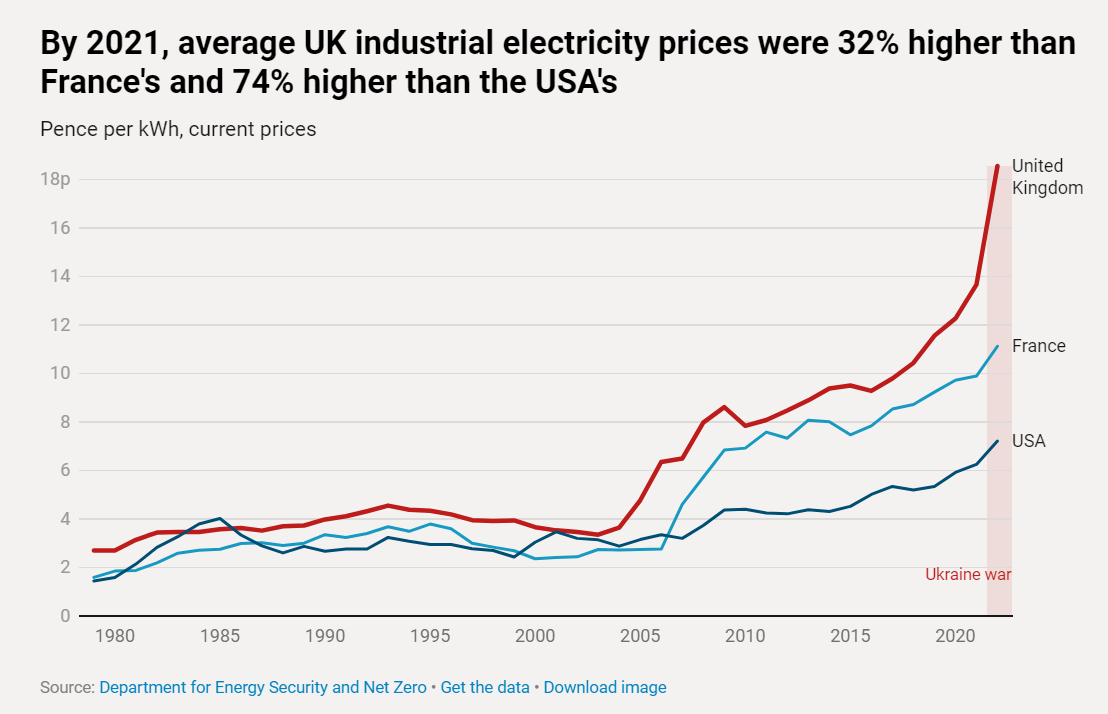

Because the UK’s electricity prices are indeed too high. The authors of Foundations illustrate this in various ways, but most compelling with the following chart:

The nuclear explanation offered above does not hold water. The last nuclear power station completed in the UK, Sizewell B, came online in 1995. The UK had built at least one new nuclear power plant around every five years since the 1950s before that date. Sizewell B had been first proposed in the 1960s as another member of the UK’s Advanced Gas Cooled Reactor (AGR) fleet before going through a number of design changes and a lengthy public enquiry before starting construction in 1987. But Margaret Thatcher’s original vision of a new fleet of nuclear power stations never happened.

The reason why is a matter of public record. New nuclear power stations were considerably more expensive than building a new fleet of combined cycle gas turbine (CCGT) power stations. These were able to achieve thermal efficiencies of 55-60% and make best use of cheap North Sea gas. We stopped building nuclear power stations because we had a cheaper alternative.

And this was not simply a matter of Government making the wrong investment decisions. At privatisation the new generation companies refused to take on the UK’s existing nuclear fleet, judging both its running costs and potential liabilities as being not worth the candle. The Government kept them in public hands and forced utilities to buy power from them through the Non-Fossil Fuels Obligation. If we had maintained the nuclear build-out under public control, we would have had higher electricity costs throughout the 90s and 00s. And, consequently, lower growth.

The Perils of Geology

The second explanation the authors put forward is that the increased use of wind and solar in our power system is driving costs up. This is not because of how much it costs to build out these technologies, but rather the costs of integrating them into our electricity system - more transmission lines to where the wind actually is, increased costs of balancing to accommodate intermittency, and the need to pay for backup for periods of low wind and low sun.

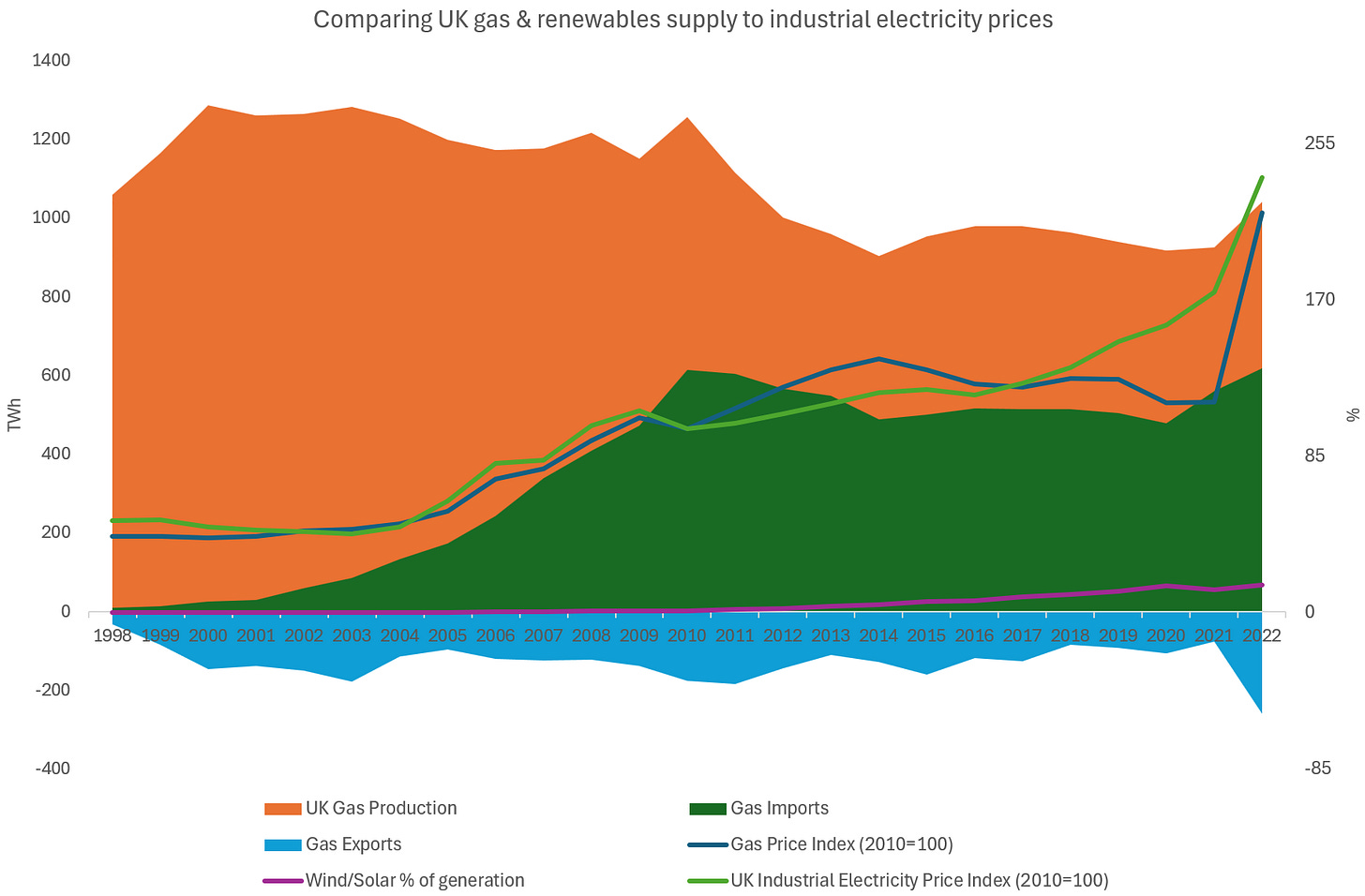

I will return to these integration costs later, but for now, I want you to consider the following chart:

The reason why we cancelled our nuclear build-out and the reason why industrial power prices are now high is the same: the price of gas. The CCGT fleet we built in the 90s is now driving prices higher. The bounty of the North Sea ran out in the 2000s and we now import the majority of our needs. As a result, our marginal gas supply is liquified natural gas traded on global markets over which we have little control. Even the minor expansion of North Sea extraction new exploration would unlock would do very little to move the dial here.

The opposite is true of the US, thanks in large part to shale gas and fracking:

But this was never a meaningful option for the UK. Our geology is more complex - not all shales are created equally - and our political topography is even more so. We are a small densely populated island and some of the richest shale reserves lie under areas populated by similarly rich - and powerful - people.

Without climate policy, the UK in the 2000s would almost certainly have returned to coal power rather than nuclear. And there were efforts to do so. However, they came a cropper largely thanks to carbon pricing in the form of the EU’s Emissions Trading Scheme, which meant that even burning LNG beats burning coal. We should indeed have restarted our nuclear build programme earlier in the 2000s than we actually did. Labour commited to nuclear power in its 2005 manifesto, and by 2010 both main parties had it as an objective. That we have failed to deliver it is a function of our sclerotic regulatory system.

Renewables are very much a bit player in this story. The reason why prices are high today is because of choices that were made in the 1980s, by a Government that short-sightedly assumed the private sector would manage long-term price risk on its behalf. But the private sector cannot overcome the constraints of geology. We have built an energy system that depends on the North Sea being fruitful, and have failed to respond to it no longer being so.

The cost of renewables

However, it’s not enough to demonstrate that over-reliance on gas is the cause of our current electric disadvantage. The contention of the Foundations authors is that mooted cheap renewables add costs to the system that aren’t included in any headline price figures. This is true; ‘levelised cost of energy’ numbers one occasionally sees banded around exclude important costs. This is why the Government has sought to more accurately capture these additional costs. If we are debating about what we should invest in rather than simply how to stop banning investment, then the right question to ask is what proportion of renewables on the system represents an optimal outcome for consumers, taking these costs into account.

However, I am concerned that the analysis presented in the paper over-eggs these costs the other way. Let’s look at the arguments presented in turn.

More need for transmission lines to connect generation to households and industry. Traditionally, power plants were located fairly close to major population centres. The highest wind speeds, however, are available offshore and in northern Scotland. Add in the impact of the planning system pushing wind farms to locate in more remote places, and the result is that the annual costs of transmission maintenance and installation have risen from £1.35 billion in 2008/9 to over £4 billion in 2024/25. The UK’s electricity system operator plans for £54 billion of total transmission spending between now and 2030, citing the need to accommodate a large increase in offshore wind generation during this period.

The Foundations paper is a clarion call to make infrastructure cheaper to build, which I heartily endorse. Arguing in the same paper that the current cost of infrastructure is a reason not build it somewhat begs the question. We need infrastructure to access resources, and when the location of those resources change, we need to build more. The question is whether that additional cost is worth the value of the additional resource.

To put the costs set out above in context, the £54bn for 2030 infrastructure will be amortised over 45 years, meaning that that actual in-year impact will be closer to an increase of 20-30% on current transmission network charges. Transmission costs themselves are currently about 7-10% of the consumer retail bill.

However, we still need to bear down on these costs. In the event that we tackle some of the issues around planning that the Foundations paper identifies, the cost of new transmission lines will decrease. We also need to tackle our monopolist framework for delivery, which I will discuss in a subsequent post.

Increased grid balancing costs. Electricity supply must be matched to demand on a second-by-second basis. As increasing fractions of the generation mix become weather-dependent and hence to a degree uncontrollable and unpredictable, the grid operator needs to spend more money both on paying generators to switch off when supply exceeds demand, but also for emergency backup generation to come online when wind speeds drop. These balancing costs are estimated at £2.4 billion for 2023/24, and are estimated by the Electricity System Operator to rise to over £4 billion a year by the end of the decade.

It is most peculiar that the authors of Foundations opted to raise grid balancing costs immediately after flagging transmission costs, because transmission costs are in large part intended to ameliorate balancing costs.

‘Constraints’ are the component of balancing costs that relate to an inability to get power to where it is needed. This is switching off Scottish wind when there’s not enough connectivity to get it to England, and switching on a gas plant near London at the same time to compensate.

Building more transmission infrastructure reduces constraints which reduces balancing costs. Optimising the right amount of transmission infrastructure versus constraint costs is of course vital; there is a very good argument that we are getting the balance wrong. Part of the challenge is that our national control room is not yet set up to operate a low carbon grid, and is running at pace to do so.

In fairness to the Foundations authors, what is clear is that adding more wind to the system also adds transmission or constraint costs. These costs should absolutely be added when we compare different generation costs, but they shouldn’t be simply combined for the purpose of this evaluation.

The costs of paying for backup capacity. This is especially important for periods of multi-week lulls in wind speeds, which can occur during periods with overcast weather that curtail solar generation as well. These periods require a fleet of dispatchable plants with total capacity approximately equal to peak demand, powered either by gas or, in some envisioned Net Zero scenarios, hydrogen stored for years in underground salt caverns. Batteries may become viable for energy storage across a day or a few days, but seem unlikely to be able to provide for weeks-long lulls in wind and sunlight. Currently the UK has 4.6 gigawatt-hours of battery storage capacity, or about 0.3 percent of daily energy demand.

Since these plants will, in optimistic Net Zero scenarios, operate relatively rarely and so be unable to sufficiently recoup their costs through electricity sales alone, they will likely require ongoing subsidy. So far we have committed over £3.6 billion to pay for backup energy supply in 2027/8, based on recent auction results, and it is unclear if even this expenditure is sufficient to ensure security of supply given the planned partial reliance on electricity imports from Europe.

We do not need to match peak demand exactly with a fleet of dispatchable backup plant.

Firstly, even during an extended anti-cyclone during winter - when wind is low and skies are overcast - renewables still produce electricity. The below chart shows the de-rating factors representing the volume of output from renewables that the System Operator believes can be reasonable expected during a system stress event.

Very small amounts of power, but amounts nonetheless.

Secondly, this only applies if we build an exclusively solar and wind-based power system. We will indeed continue to build out nuclear, use our existing hydro resources and potentially continue to use biomass for electricity production. We will also make further advances in storage; over 50GW of batteries are in the pipeline, as well as other technologies that provide longer duration output, and batteries at least are coming to market without any support at all.

Will we need any backup generation? Yes, but most of this generation already exists and has recovered its capital costs. I fully expect the at least partial nationalisation of most of the existing gas fleet as soon as it becomes obvious that it’s cheaper to do that than, as the authors identify, continue to pay billions in capacity payments to them each year.

Towards a Cheaper System

The aim of the Foundations paper is to push for growth, an aim I endorse. In this post I have set out a few reasons why their explanation for our current high prices might not hold water. In a subsequent post, I want to turn to what radical steps we can take to reduce costs. As a sneak preview, this will involve:

Breaking monopolies;

An overhaul of Bristol;

A new regime for steam, and;

Building beyond the sky.

Agree 'capacity approximately equal to peak demand' is a weird assertion. In a system with ccgt and batteries when there's no wind or sun, ccgt can charge batteries off-peak and then batteries can meet the peak demand (along with the same amount of ccgt) - would only need ccgt to meet mean demand not peak.

thanks massively simplifies the Foundation paper which i got bogged down with and now will return back at look at certain sections. Be nice if Millibrain had tackled these areas first before firing off at all different angles although i do hope he will realise that the NESO2030 report is warning him off the 2030 goal and he resets it. There will then be an opportunity to both have a viable plan and do something about our over reliance on imports now for most of the kit creating green jobs everywhere except the UK.

By the way batteries are in the capacity market albeit derated